Do CEOs Time Option Grants Relative to Stock Splits?

Editor’s Note: This is a guest post by Richard Warr, a professor of finance and head of the Department of Business Management at NC State. He blogs about finance research at Finance Clippings.

Do CEOs time their stock option grants to take advantage of stock splits?

To answer this question, we need a quick recap of options grants and splits.

Stock option grants frequently make up a significant portion of a CEO’s compensation package. Typically an option is granted to the CEO “at the money,” meaning that the price at which it can be exercised (known as the “strike price”) is set close to trading price of the stock. If the stock price increases after the option grant, the value of the option will increase. This is a standard property of call options and is the prima facie reason for granting them in the first place.

Stock splits are, by and large, cosmetic changes to the stock. A two-for-one stock split results in each share of stock being replaced with two shares. In such a split, the stock price should fall in half, so a $100 stock will split to two $50 stocks. In reality, however, the $100 stock splits (on average) into two $51.50 stocks. In effect, a $3 or three percent gain in value occurs on the announcement day of the split. The key thing to note here is that this is “on average.” Why this gain occurs is a bit of a mystery and beyond our discussion today.

So given these two factoids – options are granted at the money and stock splits result in a price increase (split adjusted) – when would a CEO most likely want to get an option grant?

- A. Before the split announcement.

- B. After the split announcement.

- C. The CEO shouldn’t care.

If you answered A, then you’d be right – and this is supported by the data.

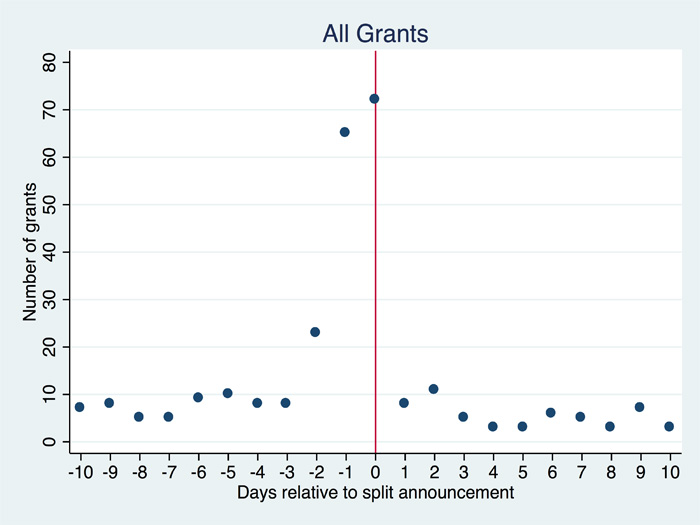

This figure shows the aggregate number of grants made to CEOs relative to split announcements (on day 0). We can see a clear clustering of grants before the announcement. So what’s going on?

Because a grant is granted “at the money,” the three percent price bump that occurs on the split announcement results in an immediate increase in value for the holder of the option (the CEO). Therefore a CEO would prefer to get his or her options before the split rather than after it.

But the story is actually a little more complex – because we found that grants occurred before the split even if they were scheduled (scheduled grants occur at a pre-determined time each year). This means that in some cases the split announcement is being timed relative to the grant.

OK, but so what?

We think this finding is important, because, by announcing the split after the grant, a CEO will (on average) see his or her wealth increase by more than $450,000! This gain is based on the size of the grant and the effect that a three percent stock price increase has on the value of the option.

And in case you are wondering, CEOs also appear to time their stock trades relative to split announcements.

These trading patterns are not illegal, but they should perhaps raise eyebrows for stock investors who ultimately foot the bill for all CEO compensation. In some cases, these actions seem to be not in the spirit of the original option grants, which are designed to reward long-term value creation rather than quick gains.

I co-authored a paper on these findings, “CEO Opportunism?: Option Grants and Stock Trades around Stock Splits,” which is forthcoming in the Journal of Accounting and Economics. The paper was co-authored by Erik Devos (University of Texas at El Paso) and William Elliott (John Carroll University).

- Categories: