accounting

How to Build a Team of ‘Appropriately Skeptical’ Financial Statement Auditors

Senior Staff Give More Constructive Feedback When They Think They’ll Work With You Again

How Companies Worked Around a Law Aimed at Keeping U.S. Tax Dollars from Going Overseas

New Audit Rules Had Little Effect on Companies

Accounting Transparency Effort Tied to Decreased Funding for Innovation

When Taxes Go Up, Execs Increase Profits from Insider Trading

Taxing Cryptocurrency: What Happens When Crypto Crashes?

Report Reveals Risk Management Processes in U.S. Organizations Are Not Keeping Pace With Growing Risks

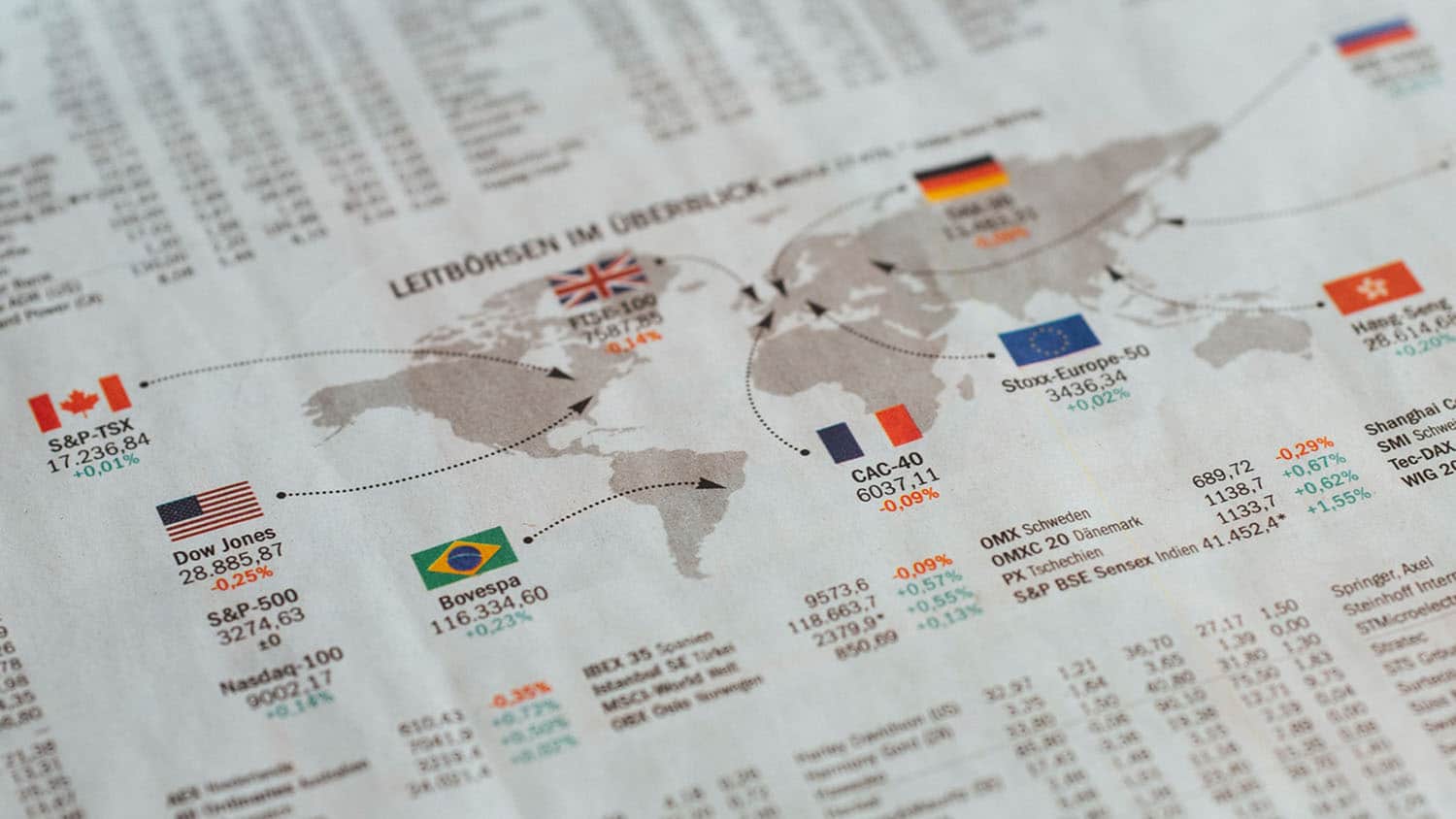

‘Tax Haven’ Companies May Be Less Risky Than Investors Think

Companies That Are Aggressive on Taxes Fall Short at Managing Their Workforce

Accounting Students Provide Free Tax Return Assistance

Study Finds At Least Some Auditing Expertise Applies Across Industry Sectors

Study Highlights Challenges of Encouraging Skepticism in Financial Statement Auditors

Tax Havens Can Have Hidden Costs for Corporations